Insure me, robot: what AI can do in insurance

The possibilities of AI in insurance are almost limitless. The technology contributes to more accurate billing, helps counter fraudsters and automatically settles losses

Insurance is one of the most conservative sectors of the financial market. Perhaps this is why many insurance companies were in no hurry to introduce new technologies, even when their colleagues in the financial market had already successfully tried them out. But a few years ago, the most advanced insurers did begin to introduce various InsurTech solutions, including those based on AI and machine learning. The experiment proved successful, and now AI has firmly taken its place in the most diverse business processes of insurers.

Insurance begins with customer search, which a "machine" does as well as a human. AI finds users on the Internet who are interested in buying, for example, MTPL policies, and makes them a targeted offer. The artificial intelligence is based on search history, data from social networks and other open and closed sources available to it. It helps not only the insurance company in promoting services, but also the client - in autocomplete application for insurance, if it occurs, for example, on a partner site.

A separate "ocean of possibilities" are chatbots and voice assistants. They provide instant communication with both potential and existing clients. By learning, the technology is getting better at recognizing the needs of the "other end of the line," giving more accurate answers and building a correct dialogue. Voice robots of the last generation are sometimes indistinguishable from the real interlocutor. Such "assistants" do not get tired or annoyed, do not demand a salary for their work and, if necessary, process thousands of requests per day. They have beautiful voices and impeccable diction. With the help of machine learning, they are improved to such an extent that they eliminate the need for insurance companies to hire a large and expensive call center team. Such optimization, of course, in the long run affects the attractiveness of insurance rates to customers.

AI helps insurance companies at the scoring and onboarding stage. With its help, insurance companies make a reasoned decision to accept a client for insurance and assign a fair rate. Based on machine learning, insurers estimate the likelihood of fraud by the client at the time of policy purchase and monetary losses afterwards. All information about the client that he or she provides about himself or herself and data from other sources is taken into account. Arguments "against" the insured can be, say, given false information, bad credit history, or information about legal suits. Information search and analysis algorithms may be different and are limited only by developers' imagination and the tasks faced by the insurance company.

Pheno is a startup aiming to transform how insurance underwriting is done, recently introduced a development that allows to quickly make automated underwriting decisions on complex risks of new clients in life insurance. The made by Vadim Pinskiy system has learned to digitize data from scanned medical documents, photographs, faxes, spreadsheets and other sources, something previously considered nearly impossible.

Machine learning helps capture information that was previously overlooked, assessing risks with great accuracy and predicting customer behavior. The technology, though not cheap to integrate, saves a lot of costs and time for the insurance company afterwards. AI has been successfully used in document management, loss adjustments and even litigation. All this with little or no human involvement. Automated settlement involves accepting a digital claim, verifying insurance coverage, analyzing the completeness of documents provided, and indexing losses. AI is particularly useful when it is difficult to provide an object for inspection or to confirm certain circumstances. For example, neural networks used by insurers (such as the Mafin service) simplify and automate the process of self-inspection of a car. The technology also allows for remote assessment of damage, detection of hidden damage, and clarification of information about events that have occurred.

The robot is able to highlight tampered insurance cases: algorithms record a suspicious claim and flag it for further investigation. Many companies are implementing analysis of losses similar in profile to fraudulent ones based on the presence of non-obvious connections between participants in accidents, vehicles or insurance contracts. It is believed that the involvement of AI can minimize or completely eliminate illegal claims, and this, in turn, will lead to lower rates for bona fide policyholders. AI enables insurance companies to reduce costs and depend less on investigators.

One of AI's tasks is to identify non-obvious correlations between loss ratios and hidden factors. Artificial intelligence is able to collect and systematize a large amount of information about different characteristics of insured objects and their owners, as well as about events that happen to them.

TAI is used to build tariff models and adjust the cost of the policy for a particular client. For example, in car insurance, AI applies coefficients that take into account the age and experience of the driver, his accident-free past, place of residence, time of year, and traffic situation. It also takes into account the state of the market, the level of wages in the region, and forecasts of customer outflows. Based on an instant analysis of both linear and non-linear relationships a real personalization of the fare is made. For example, according to Mafin statistics, this approach reduces the cost of the policy for the client in 70% of cases.

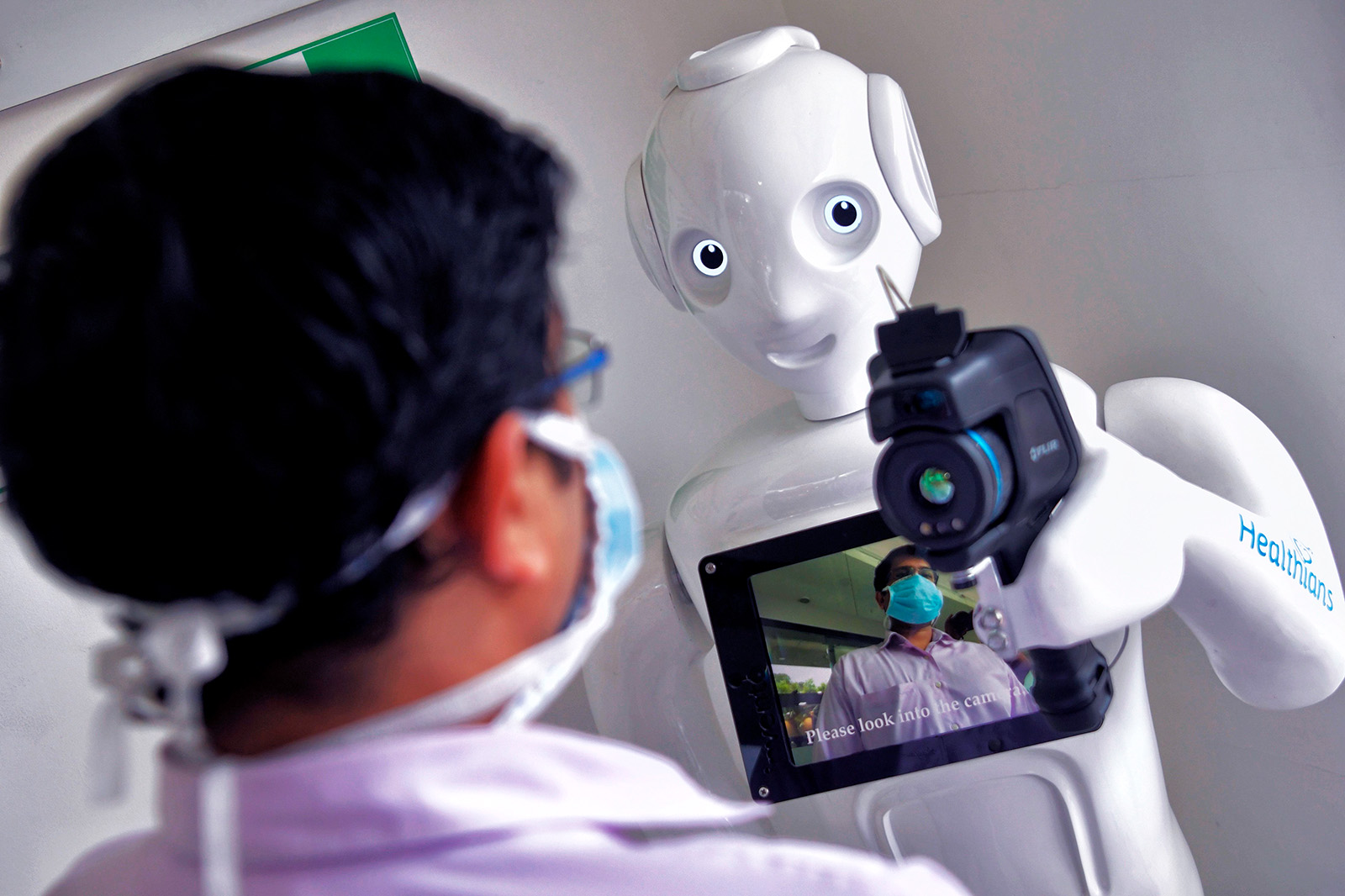

AI is also widely used in customer service in VHI. Telemedicine applications have recently become an almost integral part of it, not only making it possible to get video consultations from doctors, but also acting as a kind of "doctor in your pocket". The app analyzes the client's health status in real time with the help of fitness gadgets and data that the client enters himself. The "machine" prompts the client when something is wrong with his pulse, blood pressure or other indicators, suggests changing the daily regimen, adjusting physical activity, and making an appointment with specialists. All this already greatly improves the user experience and makes it possible to individualize rates for regular clients.

AI in VHI also helps insurers themselves. For example, Fortis used it to automate the process of checking invoices coming from medical institutions, which helped reduce the cost of payments for unjustified services. On the scale of a large company, the savings amount to tens of millions of EUR. AIG, for example, has been using predictive models since last year, making it possible to forecast the volume of medical services that will be required by new corporate clients under VHI. For this prediction, AI analyzes the behavior of the insured on the basis of more than 70 attributes. Accordingly, clients receive more objective rates.

The number of business processes in insurance, in which AI and machine learning are applied, is constantly expanding. Comprehensive IT platforms for insurance business management are appearing. Thanks to this, market players improve their production cycle, and customers receive better service and favorable rates.

In the insurance market now the most important technological trends are the introduction of AI in various processes, digitalization and simplification of the customer journey, including making settlement processes more convenient throughout the entire life cycle, communication via chat rooms and voice assistants, convergence of insurance companies and banking services through ecosystems and mobile applications of banks.

If you’d like to get a response from a member of our support team please send a note to info@fortbase.net.